The 3 Most Important Investment Strategies for Digital Nomads

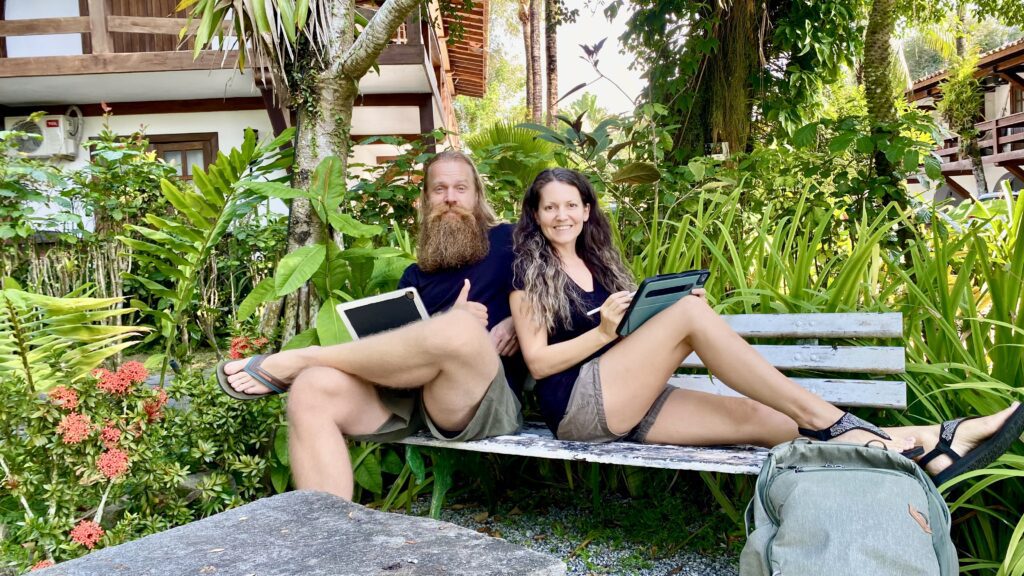

Financial stability for digital nomads isn’t about keeping all your money in one place—it’s about smart diversification. Long before I became a full-time traveler, I worked as an investment consultant. I built my investment portfolio piece by piece, ensuring I wasn’t tied to a single economy, bank, or asset class.

Now, after nearly five years on the road with my partner Alexandra, applying Flag Theory isn’t just a strategy—it’s essential.

By spreading investments across different countries, currencies, and asset types—crypto, metals, stocks, and real estate—we create financial resilience. This approach shields us from sudden banking restrictions, currency fluctuations, and political instability. We regularly advise fellow nomads and expats on securing their assets, and this article outlines a blueprint for long-term financial security. If you’re looking for personalized guidance, feel free to reach out.

1. Spread Your Wealth: The Multi-Asset Approach

A solid financial strategy for digital nomads starts with organization. Before diversifying, track what you have and where—create a simple spreadsheet to monitor your assets across different accounts and investments. The goal? Ensure every category has enough to keep you financially secure, no matter where you are.

What should your portfolio look like?

A well-balanced portfolio for a nomad isn’t just about stocks. Instead, it should include:

Crypto: A Hedge Against Inflation and Banking Restrictions

Bitcoin (BTC) and Ethereum (ETH) remain strong long-term options, but if you’re comfortable with more risk, exploring alternative coins could be worthwhile. Popular platforms like Binance and Coinbase offer accessibility, but Kraken stands out for its competitive pricing and global availability.

Precious Metals: Stability in Uncertain Times

Gold and silver provide a hedge against market volatility, but deciding where to store them depends on your risk tolerance. Physical metals can be useful in crisis situations—small silver coins, for example, might be tradeable. However, carrying them while traveling poses security concerns. Online vault storage in countries like Singapore, Switzerland, Canada, and the U.S. offers an alternative, allowing investments in gold, silver, platinum, and palladium. My favorite platforms are OneGold, GoldMoney and Goldsilver.

Stocks: Invest in What You Use

If you spend $1,000 on an iPhone, consider investing $1,000 in Apple stocks. The idea is simple—if you believe in a product enough to buy it, investing in the company aligns with your lifestyle and confidence in its future. Aim to hold one month’s worth of expenses in stocks over time. Interactive Brokers is a solid choice, especially for digital nomads in Paraguay, as it offers fewer restrictions compared to traditional banks and brokers. Paraguay also offers tax advantages, with no capital gains tax and no taxation on cryptocurrency.

Bank Accounts: Diversify Across Jurisdictions

Holding accounts in multiple countries minimizes risks related to currency controls and unexpected policy changes. In Europe, online banks like Wise, Revolut, N26, DKB and PayPal offer low or no fees. For the U.S., options like Mercury, Wise, Payoneer, and PayPal are ideal. If you own a foreign-owned single-member LLC, Mercury Business Accountsare a great option. Need assistance setting one up? Let me know.

Keeping Liquidity: The One-Month Rule

Rather than concentrating funds in a single investment, aim to hold exactly one month’s worth of expenses in each asset class. This way, if one investment underperforms or becomes temporarily inaccessible, you always have liquidity elsewhere. Over time, this approach builds a financial safety net spread across multiple assets, ensuring flexibility and security no matter where you are in the world.

2. Flag Theory in Action: Banking & Tax Optimization

Flag Theory suggests that digital nomads should establish different financial “flags” across multiple jurisdictions to maximize financial security, tax efficiency, and flexibility.

Here’s how to apply it:

Residency in a Tax-Friendly Country

Choosing a residency with low or no taxes can significantly reduce your financial burden.

- Paraguay remains one of the best options for digital nomads due to its territorial tax system, meaning you only pay taxes on income earned within the country. The residency process is straightforward and cost-effective.

- Panama offers another tax-friendly residency program, but the required investment is much higher. It’s ideal for those managing larger investment funds or willing to make a significant financial commitment.

- Need help? If you’re interested in other options, or need reliable contacts for setting up residencies in either Paraguay, Panama, or other Latin American countries, let us know.

Bank Accounts in Stable Economies

If you establish residency in Paraguay, opening a local bank account can provide easy access to Guaraní, a relatively stable currency. In general, holding bank accounts in multiple countries and currencies helps mitigate risks associated with currency fluctuations and banking restrictions.

Business Incorporation in a Tax-Optimized Country

For digital nomads running online businesses, incorporating in a tax-friendly jurisdiction is crucial.

- U.S. LLC (Limited Liability Company): A foreign-owned, single-member LLC in the U.S. is a popular choice due to its simplicity and tax benefits.

- Florida LLC: I personally recommend setting up a Florida LLC, as it has the lowest annual costs—around $200 per year, including the registered agent and all fees.

- Why Paraguay + U.S. LLC? A residency in Paraguay (territorial tax system) + U.S. LLC (pass-through entity for foreign owners) is a great combination for nomads. It allows you to legally optimize taxes while keeping your business structure simple.

Want more details on setting up a U.S. LLC or optimizing your tax strategy? Schedule a call with me to discuss your best options.

3. The 50K+ Growth Plan: Moving Towards Real Estate & Business

Being a digital nomad often starts with digital assets, but true financial security comes from diversification into tangible investments. The ultimate goal? Passive income.

Building a Strong Foundation

Think of your investments as your savings account. Track your assets and identify which one is growing the fastest—whether it’s crypto, stocks, or another investment vehicle. Keep feeding that asset until it reaches a solid threshold, such as $50K, which then becomes your launchpad for real estate or small business investments.

Why Physical Assets Matter

At some point, the wealth you build in the digital world should transfer into the real world. Serious investors own physical properties, and as a digital nomad, you should aim for the same. Investing in real estate or a hands-off business ensures long-term stability, even if your digital income fluctuates.

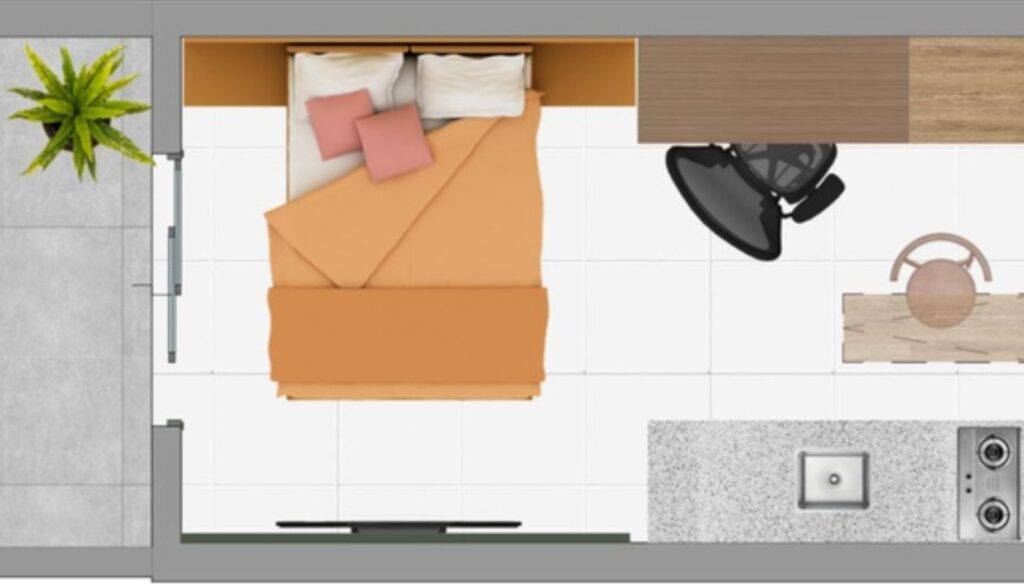

Our Strategy: Investing in Studio Apartments in Paraguay

In our case, we’re leveraging our BTC holdings to reach $50K, which we invest in studio apartments in Asunción, Paraguay—a market with high rental demand and excellent value.

- Asunción’s real estate market is emerging, with small studio apartments available at around $1,000 per square meter (~$93/sq ft).

- A well-located studio can generate $500+ per month in rental income, with minimal management effort if you work with a good property administration service.

Learn more about this investment opportunity in this article.

A similar strategy can be applied in other regions, depending on your financial goals and preferred investment markets.

Final Thoughts: The Road to Financial Independence

The key to financial resilience as a digital nomad isn’t just about making money—it’s about strategic allocation and global diversification. With the right approach, you’re not just surviving but thriving—building assets that grow, generate passive income, and protect you from financial instability.

Disclaimer: This article does not provide investment advice.

However, if you want to discuss spreading your assets, investing online and offline, real estate, residencies, or tax optimization, schedule a call with me here.

I look forward to your questions!

Paul Trausner

Lived on 4 continents and visited 60+ countries

Specializes in expat consultation for Latin America,

including residency coaching, US LLC formation, and tax optimization strategies